I have been struggling to explain the extreme economic danger we face due to the Federal Reserve's Quantitative Easing 3 (QE3). The danger comes in three parts. We will end with a quick explanation of how printing money is redistribution of wealth.

First, European central bankers recently stated that they could print as much money as they wanted with no concern for inflation, just as our Federal Reserve (The Fed), because the money goes to banks.Banks hold the money for their required reserves or trade with other large financial institutions, but the money, supposedly, does not get into the general economy and cause inflation.

This is dangerously stupid, of course the money eventually trickles-down into the economy. Printing money is monetary trickle down economics. There is one key difference, instead of savers inventively using the money to invest in new ideas, banks are regulated in how they can distribute the money. It is regulatory picking of winners and losers.

Second, our Federal Reserve (The Fed) purchases government bonds in competition with the free market. This forces down the cost of selling bonds and keeps interest rates low.

If I need to borrow $100, you might lend it to me at 10% interest and collect $110. When the U.S. Government borrows money, The Fed steps in and loans the money at under 1%. This drives down the cost of U.S. Government borrowing which in-turn sets all interest rates low. You cannot loan me that money and earn $10, because the Fed crowded you out of the market. Other interest rates are linked to the U.S. Government's interest rate because it is considered the safest and thus the base interest rate.

Ask retirees on fixed incomes how this hurts them.

Because inflation is currently higher than interest rates, savers and retirees are forced into riskier assets in order to preserve wealth. If inflation is 2.5% and you only earn 1% on your savings, you are losing wealth. So, investors put their money into real estate, gold or the stock market to earn more than 2.5%, but at a higher risk level.

Also, investors run away from cash because the printing of money instills fear that dollars will lose value. America has suffered three credit rating downgrades since the Obama Administration's massive spending starting with the "shovel ready" stimulus in 2009. As people lose confidence in our government, they lose confidence in our currency.

Gold prices are inversely related to the value of money, as gold is purchased with money. Gold has not become more

scarce,

dollars have become less valuable.

Third, financial institutions and banks loan the newly printed money to people who want to buy homes. Congress, regulators, and disgraced lawyers like Barack Obama force banks into lending money even when it is not financially sound. The banks are given incentives and face penalties or take-over by the government if they do not comply. This has the net effect of inflating the price of housing.

Economically, this is justified by the belief that the inflated housing prices create paper equity which then increases the confidence people have in the economy (consumer confidence). Reported inflation has so far stayed low because housing prices have been going down while food, energy and other prices have increased. Housing prices are a large portion of the reported inflation statistics. As housing prices increase, inflation numbers will rise, which in-turn will force savers into investments with even greater risk. Further pushing investments in real estate and creating a new housing bubble, the very reason our economy exploded in the first place.

Redistribution of Wealth

ObamaCare includes

many new taxes. One new tax is a 3.8% tax on the sale of real estate and other "investment income."

A 3.8% surtax on "investment income" when your adjusted gross income is more than $200,000 ($250,000 for joint-filers). What is "investment income?" Dividends, interest, rent, capital gains, annuities, house sales, partnerships, etc. Taxes on dividends will rise from 15% to 18.8%--if Congress extends the Bush tax cuts. If Congress does not extend the Bush tax cuts, taxes on dividends will rise from 15% to a shocking 43.8%.

As stated by

Fox News:

The ObamaCare Surtax on Investment Income

Under current law, the capital gains tax rate for all Americans rises from 15 to 20 percent in 2013, while the top dividend rate rises from 15 to 39.6 percent. The new ObamaCare surtax takes the top capital gains rate to 23.8 percent and top dividend rate to 43.4 percent. The tax will take a minimum of $123 billion out of taxpayer pockets over the next ten years.

In other words, the plan is to inflate your assets and then tax those inflated assets at an increased rate. The additional taxes are largely targeted for the new entitlement program known as ObamaCare. Even if ObamaCare is repealed, some of the new taxes are tied to the Bush Tax cuts which end in 2013. The income will not be spent to reduce the debt, so it will simply be redistributed.

The increased risk of investing required to keep up with inflation and taxes will cause some people to lose their life savings. Americans who sell homes at inflated prices, the gains will be taxed away without regard to inflation. Americans will be pushed into higher income tax brackets and 31 million Americans may face the

Alternative Minimum Tax. New ObamaCare taxes will further drain our bank accounts. Property taxes will rise.

The increased tax money will

not pay down the debt. All of this additional income will be redistributed by politicians in order to purchase dependency voters. Now, is printing money worse than you thought?

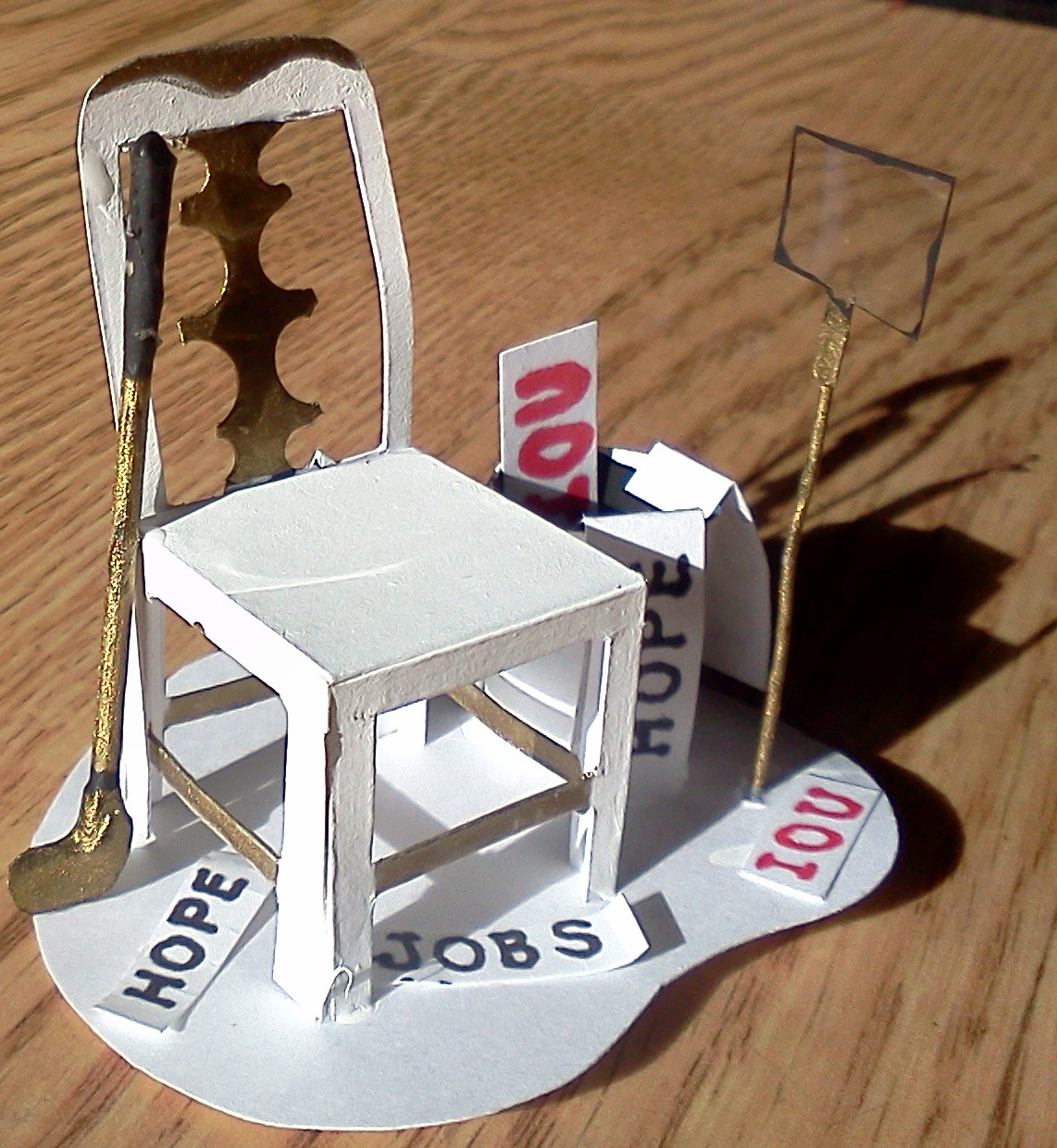

Vote for Mitt and help fight Doo Doo Economics!

+at+Smolny,+1930.jpg)