|

| Click Here for Interactive Map |

San Diego gas prices have climbed over $4 per gallon. Prices have risen from $3.56 in December to the current $4.01 per GasBuddy.com. This price is slightly down from a week ago, but uncertainty exists as this year has been very quiet in regard to summer storms. All this is occurring while 80% of Americans face poverty (by 2030 per AP) and the U.S. economy deteriorates.

(note: the 80% is "if current trends continue" which they never do.)

|

| Click Here for Interactive Chart |

High gas prices aren't a sexy topic anymore. Since George W. Bush has left office, the national news seldom reports the high gas prices so here is the information. South Carolina has the lowest prices in the country at $3.281, the national average today is $3.645 and Hawaii leads prices at $4.335. Crude oil prices have dropped over $5 per barrel since hitting $108 on July 19, and currently are holding around $103 per barrel.

San Diego Residents can find slight relief by examining this map of prices by area zip codes.

|

| Click Here for Interactive Map |

Lets review how high gas prices affect the economy.

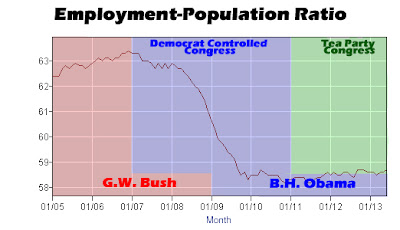

In 2007 the real estate market was weak. The housing market had inflated to the maximum through government programs which created a market for people who could not actually afford homes. These people struggled under their new inflated mortgages but other aspects of the Bush economy looked pretty good. The national media was on an economic fear campaign driven by Democrat talking points for the 2006 mid-term election and the housing bubble was obvious but the mechanism to pop the housing bubble was not clear.

The Democratic victory in the 2006 congressional elections signaled a lot to the U.S. economy. President Bush could maybe veto some insanity, but business was put on notice. Green Energy to fight the mythical scourge of global warming, minimum wage cost increases to price more consumers out of the job market, increased taxes to support government dependency spending, irresponsible handling of U.S. debt and more threatened the private economy.

The biggest threat to the economy was the fact that it had been stumbling but like a tired yet tough fighter it remained on its feet. Still, the Democrats had controlled the political narrative with outright lies and prevailed. If a new political genie had been released, some of the dumbest politicians in the country had wishes to be fulfilled. What would be next?!? Uncertainty is the biggest threat to an economy.

Immediately, the 2007 congress restricted business lobbyists, increased minimum wages, increased taxes and, in June, H.R. 6 began an global warming inspired assault on the energy sector:

Motion to Concur in the Amendment of the House to the Amendment of the Senate to the Text of H.R. 6, with an Amendment; A bill to reduce our Nation's dependency on foreign oil by investing in clean, renewable, and alternative energy resources, promoting new emerging energy technologies, developing greater efficiency, and creating a Strategic Energy Efficiency and Renewables Reserve to invest in alternative energy, and for other purposes.

Bayh Amdt. No. 1508; To provide for the publication and implementation of an action plan to reduce the quantity of oil used annually in the United States.America had stood against the global warming alarmists, but this signaled a change in policy direction. It seemed that "Global Warming" was the political genie which would destroy the U.S. Economy. Markets faltered, gas prices increased, and consumer good's prices increased due to higher transportation costs. Average Americans could no longer afford the fuel for their vacations and the money misdirected towards gasoline made it tougher for people to pay their unaffordable mortgages. Foreclosures formed an economic tidal wave.

In January 2007, the price of gasoline averaged $2.11 per gallon in the U.S. On February 7, 2007, the Democrats and the 110th Congress began enacting policies. Upon implementation of Democrat economic and political policy the price of gasoline skyrocketed.

By July 2008, the price of gasoline had reached $4.12 and the economy collapsed.Since 2008 America has printed lots of money, so the value of 2013 $4 gas is significantly less than 2008 $4 gas. However, we are approaching a dangerous threshold. Adjustable rate mortgages (ARMs) come in 1, 3, 5 and 7 year terms. Since the collapse of housing prices in 2008-2009, we have seen waves of foreclosures related to these mortgages. Due to timing, a wave of 7 year ARM related mortgage defaults may be occurring now. The question is whether housing prices have increased enough to allow these people to refinance. If not, high gas prices might be the final financial straw for many of our fellow Americans.

In the words of sarcastic teen internet meme, Thanks Obama.